Understanding the Importance of a Cover Letter

In the competitive field of insurance underwriting, a well-crafted cover letter is your first impression. It’s more than just a formality; it’s your opportunity to showcase your personality, passion for the role, and why you’re the ideal candidate. A strong cover letter complements your resume, providing context and depth to your qualifications. It helps you to differentiate yourself from other applicants by highlighting specific skills and experiences directly relevant to the job. Ignoring this crucial step can mean missing out on opportunities that could be a perfect fit. Remember, hiring managers are looking for someone who not only meets the basic requirements but also demonstrates a genuine interest in the company and the underwriting profession.

The cover letter allows you to explain any gaps in your employment history, elaborate on your achievements, and express your understanding of the insurance industry. It also enables you to showcase your communication skills, which are essential in underwriting roles. A clear, concise, and persuasive cover letter increases your chances of getting an interview. Therefore, taking the time to write a tailored and compelling cover letter is a strategic investment in your career. It’s your chance to make a lasting positive impression and get your foot in the door.

Highlighting Relevant Skills for Underwriting

When crafting your cover letter, it’s essential to emphasize skills crucial for an insurance underwriter. These skills are what set you apart and demonstrate your capabilities to potential employers. Start by highlighting your analytical skills. Underwriters spend a significant amount of time assessing risk, which requires the ability to analyze complex data, identify patterns, and draw accurate conclusions. Mention your experience with financial statements, risk assessment models, and statistical analysis software if applicable. Next, focus on your attention to detail. The insurance industry demands meticulousness; even small errors can have significant consequences. Showcase your ability to identify and rectify errors and your dedication to accuracy.

Communication skills are equally important, as underwriters frequently interact with agents, brokers, and other professionals. Mention any experience with negotiating terms, explaining policies, or presenting information clearly and concisely. Include technical expertise. Underwriting involves understanding various insurance products, regulations, and industry standards. If you have experience with specific insurance lines such as property, casualty, or health insurance, make sure to highlight them. Emphasize your knowledge of underwriting guidelines and any relevant software or tools. Finally, demonstrate your problem-solving skills. Underwriters must be able to identify potential risks, evaluate complex scenarios, and propose appropriate solutions. Providing specific examples of how you’ve used these skills in past roles will significantly strengthen your application.

Demonstrating Analytical and Decision-Making Abilities

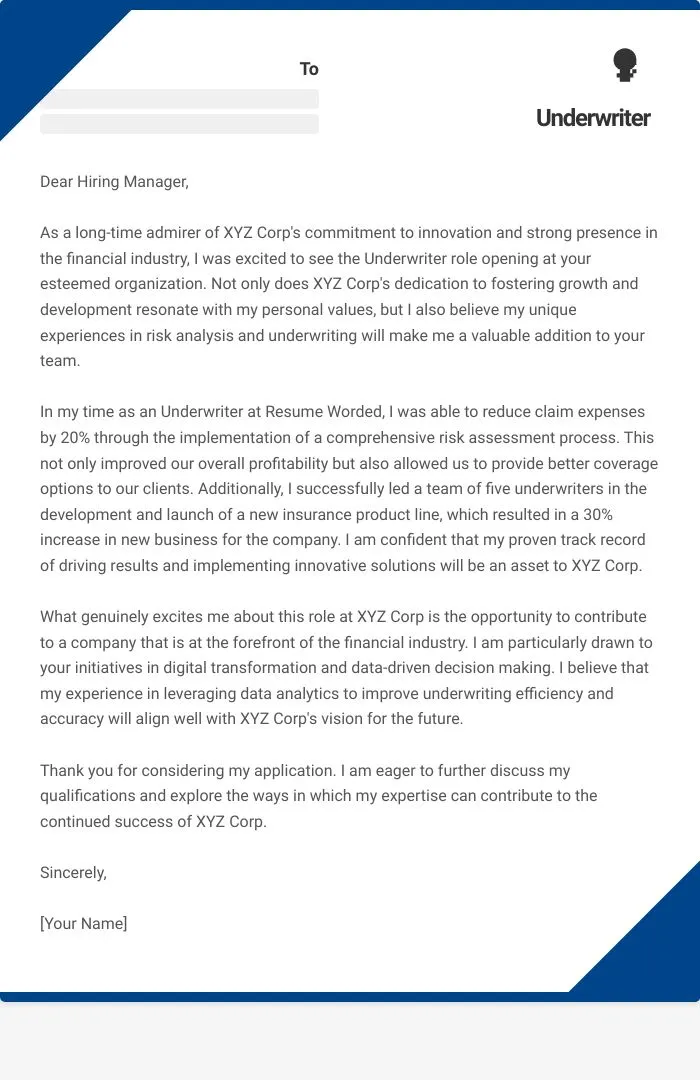

Insurance underwriters must possess strong analytical and decision-making abilities. These are the cornerstones of the profession, as your primary responsibility is to assess risk and make informed decisions based on complex data. Your cover letter should provide concrete evidence of your ability to analyze financial data, identify trends, and evaluate risk factors. Describe specific instances where you successfully analyzed insurance applications, assessed risk profiles, and made sound underwriting decisions. For example, you can mention the types of risk you’ve assessed or the amount of policies you’ve reviewed.

Give examples of how you used your critical thinking skills to solve a difficult problem or make a critical decision. Did you evaluate a particularly challenging case? How did you handle it, and what was the outcome? Furthermore, highlight your ability to use data-driven insights to make accurate risk assessments. Mention any experience with using statistical models, risk assessment tools, or other analytical software. Demonstrate your ability to manage risk by explaining how you mitigated potential threats and ensured policy compliance. The hiring manager will be looking for someone with the ability to make smart decisions under pressure, based on accurate information and insights. Providing specific examples will show them that you are the right candidate for the role.

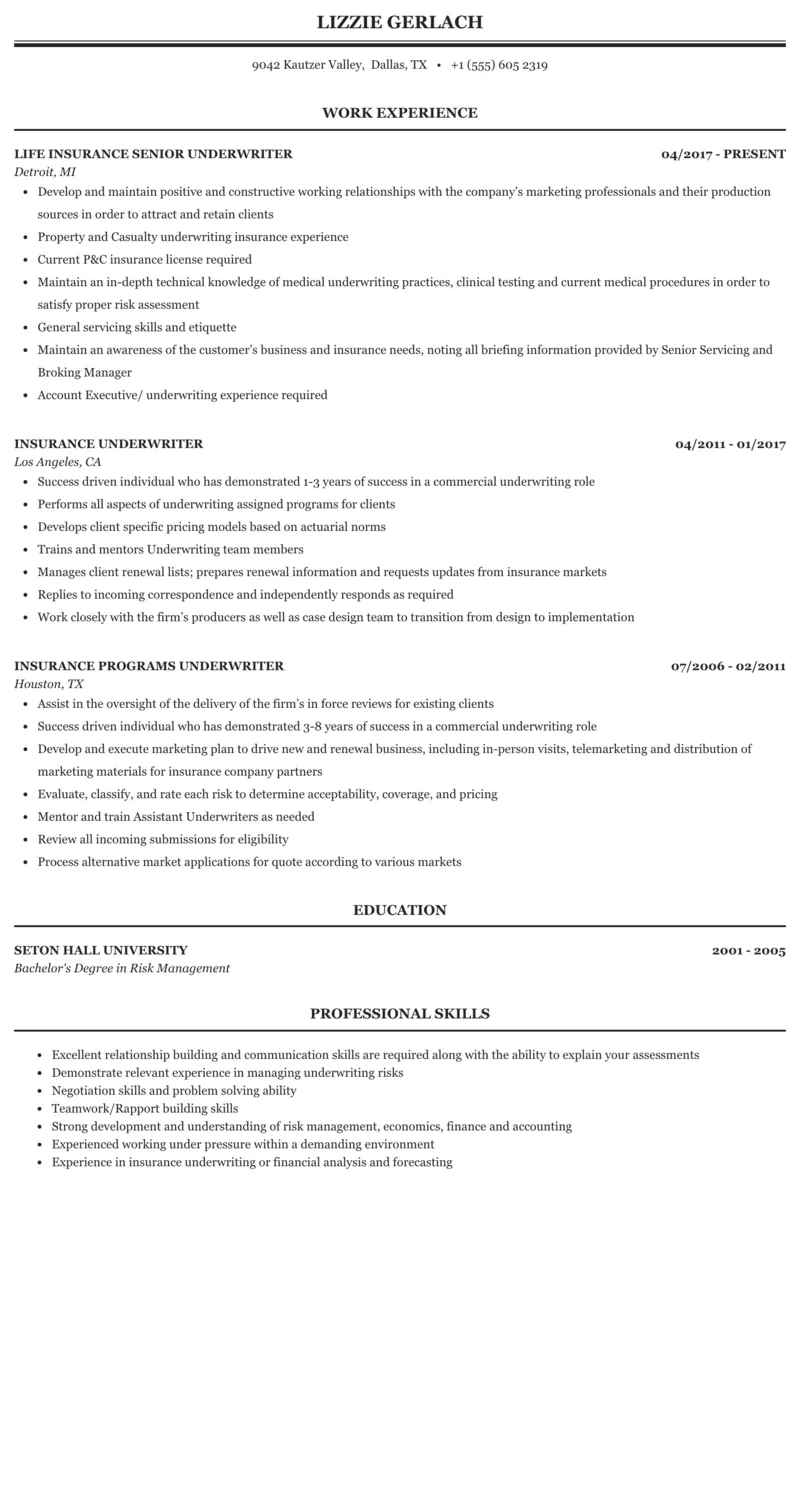

Showcasing Experience and Achievements

Your cover letter should be a showcase of your professional experience and achievements. Don’t just list job responsibilities; describe your specific accomplishments. Start by providing a brief overview of your relevant work history, including the companies you’ve worked for, your job titles, and the duration of your employment. Focus on experiences directly related to insurance underwriting or similar fields. Now, move on to your achievements. Instead of saying you “processed insurance applications,” specify how many applications you processed, how quickly, and with what degree of accuracy. Quantify your achievements whenever possible. For example, “Reduced processing time by 15%,” or “Improved policy accuracy by 10%.”

Use the STAR method (Situation, Task, Action, Result) to structure your examples. First, describe the situation or challenge you faced. Then, explain the task you were assigned or took upon yourself. Next, outline the actions you took to address the situation. Finally, detail the positive results you achieved. For instance, “In a previous role, I was tasked with reviewing high-volume insurance applications. To improve efficiency, I implemented a new workflow system, which reduced the processing time by 20% and improved the team’s overall accuracy.” These specific examples will make your cover letter more compelling. By highlighting your achievements with quantifiable data, you demonstrate your value to potential employers.

Tailoring Your Cover Letter for Specific Roles

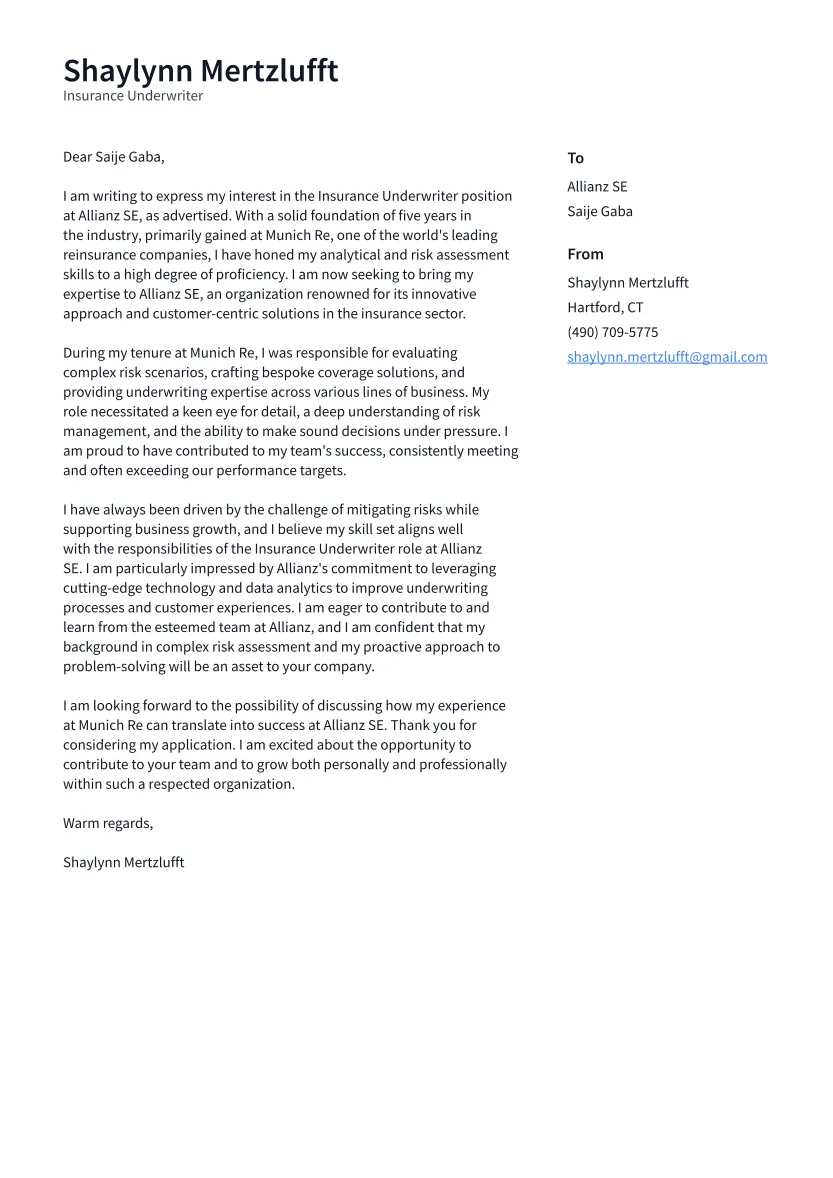

A generic cover letter won’t impress a hiring manager. It’s important to tailor your cover letter for each specific role you’re applying for. This shows the employer that you’ve taken the time to understand their needs and are genuinely interested in the position. Research the company and the specific role. Look at the job description carefully and identify the key requirements and responsibilities. What are the essential skills and experience the employer is looking for? Once you understand the requirements, customize your cover letter to address them directly. Use the keywords and phrases from the job description in your letter. This shows the hiring manager that you have the necessary qualifications and align with their needs.

Highlight relevant experiences and skills from your resume that directly match the job requirements. If the job description emphasizes risk assessment, for example, make sure to showcase your analytical abilities and experience in risk management. If the role requires experience with a specific type of insurance, highlight your relevant experience. Tailoring your cover letter to the specific role also involves addressing the company’s needs. Why are you interested in this particular company? What do you admire about their mission, values, or products? Demonstrate your knowledge of the company by referencing their recent projects, achievements, or industry standings. By tailoring your cover letter, you will demonstrate to the employer your interest in the role and increase your chances of standing out from other applicants.

Formatting and Structure: Making a Great Impression

The format and structure of your cover letter are as important as its content. A well-formatted and easy-to-read letter leaves a great first impression. Start with a professional heading that includes your contact information. Include your name, address, phone number, and email address. Follow this with the date and the hiring manager’s name and title, if known. Use a clear and professional font, such as Arial or Times New Roman, with a font size between 11 and 12 points. This ensures that your letter is easy to read. Keep your letter concise, typically one page in length. Focus on the most relevant information and avoid unnecessary details.

Use a standard business letter format with an opening paragraph, several body paragraphs, and a closing paragraph. In the opening paragraph, state the position you’re applying for and briefly explain why you’re interested. The body paragraphs should highlight your qualifications, skills, and experience, using examples to support your claims. The closing paragraph should reiterate your interest in the role and thank the hiring manager for their time and consideration. Use clear and concise language. Avoid jargon and complex sentence structures. Use bullet points or numbered lists to present information. Ensure your cover letter is visually appealing, well-organized, and easy to read. By paying attention to formatting and structure, you can make a positive impression that sets you apart from other applicants.

Proofreading and Editing: Ensuring Perfection

Proofreading and editing are crucial steps in the cover letter writing process. A single grammatical error or typo can undermine your credibility and damage your chances of getting an interview. Before submitting your cover letter, carefully proofread it for any errors in grammar, spelling, punctuation, and formatting. Read your cover letter aloud to help catch any awkward phrasing or sentences that need improvement. Use a grammar checker like Grammarly or other online tools to identify and correct any errors. However, remember to review the suggestions made by these tools and ensure the corrections are appropriate for the context.

It’s also helpful to have someone else read your cover letter. A fresh pair of eyes can easily spot mistakes that you might have missed. Ask a friend, colleague, or career counselor to review your letter and provide feedback. Ask them to check for clarity, conciseness, and overall effectiveness. Ensure the tone of your cover letter is professional and matches the industry standards. Avoid casual language, slang, or overly familiar expressions. Make sure your cover letter is free from any unprofessional content that might negatively affect your application. By dedicating time to proofreading and editing, you can ensure that your cover letter is polished, error-free, and presents you in the best possible light.

Key Takeaways and Next Steps

Writing a compelling cover letter for an insurance underwriter position is a vital step in your job search. Remember to highlight your skills, experience, and achievements and tailor each letter to the specific role and company. Always proofread your letter and ensure it’s free from errors. Take the time to perfect your cover letter to make a great impression. Now, consider the next steps in your job search. Once you’ve crafted a strong cover letter, use it to apply for various positions. Research companies that interest you and identify the underwriting roles. Tailor the cover letter to each application. Prepare for the interview by practicing common questions and researching the company. By taking these steps, you can increase your chances of success.

Consider obtaining relevant certifications or further education. These can enhance your credentials and demonstrate your commitment to the underwriting profession. You can also network with professionals in the industry. Attend industry events, join professional organizations, and connect with others on LinkedIn. By following these steps and continuously refining your application materials, you can boost your chances of getting hired and advancing your career in insurance underwriting. Remember, your cover letter is your chance to make a positive first impression. Good luck with your job search!