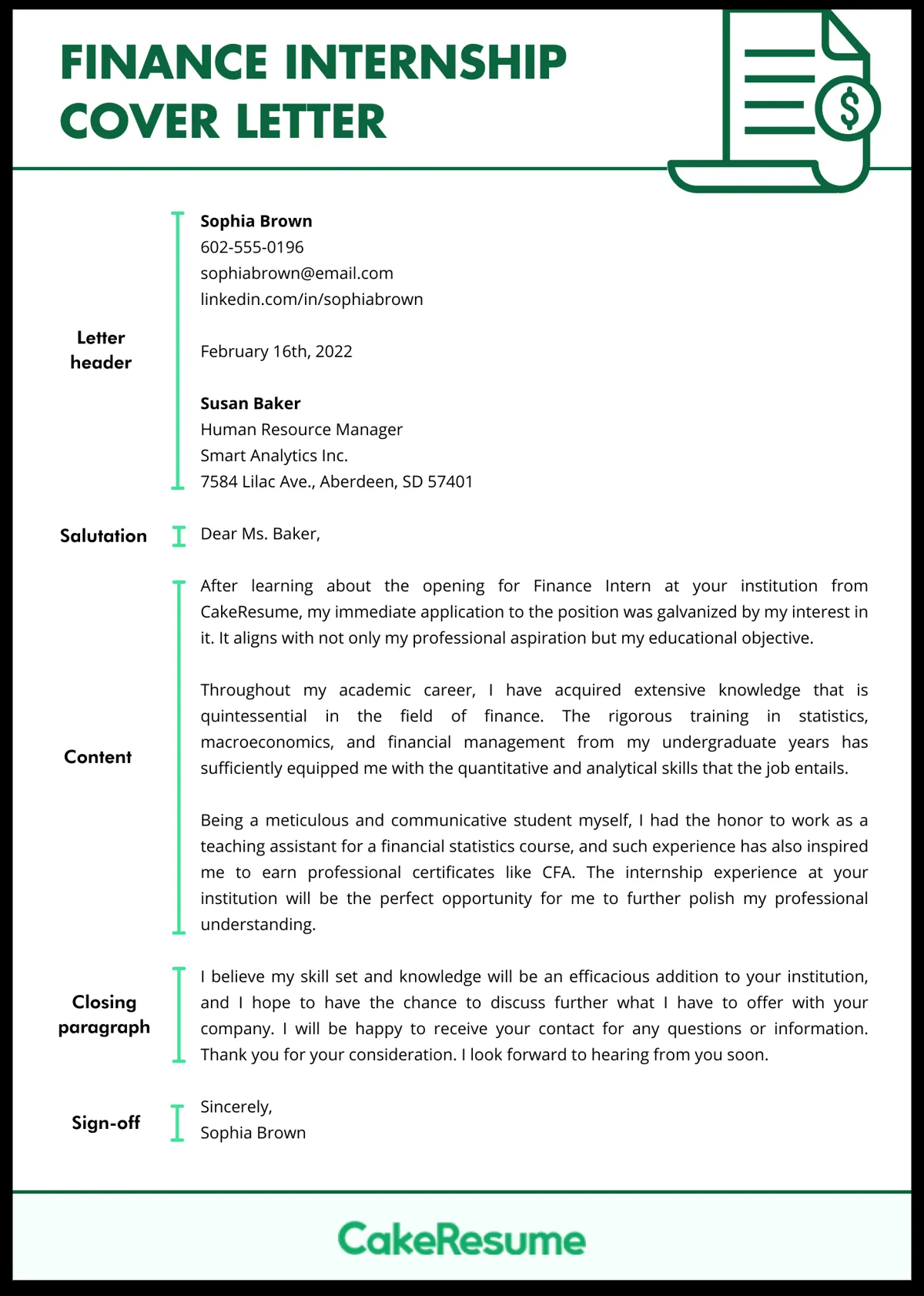

The Importance of a Wealth Management Internship Cover Letter

A wealth management internship cover letter is your first and often only opportunity to make a positive impression on a potential employer. It’s your chance to showcase your skills, experiences, and enthusiasm for the field of wealth management. Unlike a resume, a cover letter allows you to tell your story, explain your motivations, and demonstrate how your qualifications align with the specific requirements of the internship and the company’s values. A well-crafted cover letter can significantly increase your chances of securing an interview and ultimately landing the internship. Many candidates fail to understand the importance of the wealth management internship cover letter, often opting for generic templates. These candidates generally get filtered out by the recruiter, as the cover letter is a great opportunity to distinguish yourself from the crowd, by providing evidence of your research of the company.

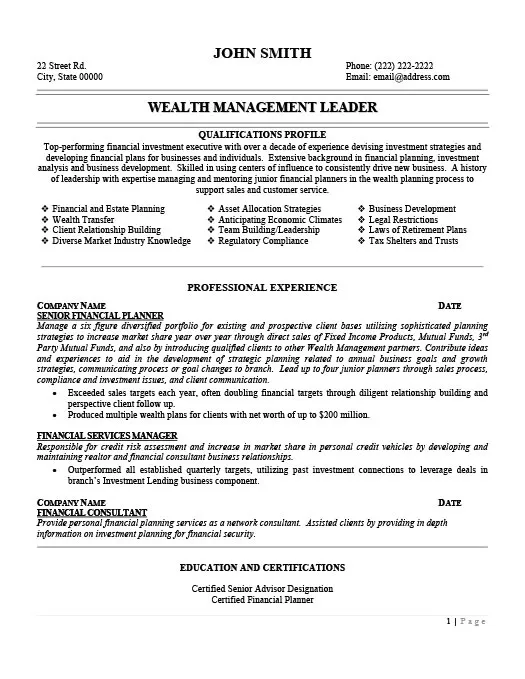

Highlighting Relevant Skills and Experience

When writing your cover letter, the focus should be on highlighting the skills and experiences most relevant to the wealth management internship you are applying for. Review the internship description carefully and identify the key qualifications the employer is seeking. These might include analytical abilities, communication skills, knowledge of financial markets, and proficiency in relevant software. Use your cover letter to provide concrete examples of how you’ve demonstrated these skills in your academic, professional, or extracurricular experiences. Quantify your achievements whenever possible, using numbers and data to showcase the impact you’ve made. For instance, if you managed a budget for a student organization, specify the budget size and any positive outcomes you achieved, like cost savings or increased fundraising. This will help demonstrate that you possess the skills the company is looking for. This approach clearly illustrates your capabilities and makes your application more compelling.

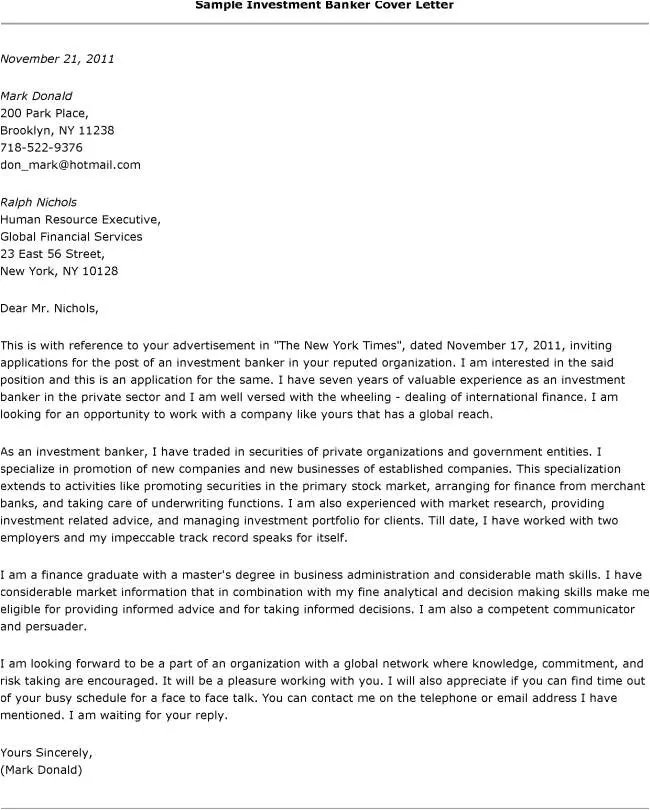

Communication and Interpersonal Skills

Communication and interpersonal skills are absolutely vital in the wealth management field. Wealth managers spend a great deal of time interacting with clients, understanding their needs, explaining complex financial concepts, and building strong, trusting relationships. The ability to communicate clearly, concisely, and persuasively, both in writing and verbally, is paramount. You must show your ability to actively listen, empathize, and build rapport with clients from diverse backgrounds. In your cover letter, provide examples of situations where you successfully communicated with others. Highlight your experience with presentations, writing reports, or resolving conflicts. Mention any group projects, leadership roles, or volunteer experiences that required you to work collaboratively and communicate effectively with your team. The ability to demonstrate effective communication will give you an edge in the competition.

Why Communication Skills are Crucial

Effective communication is at the heart of successful wealth management. Clients rely on their advisors to translate complex financial information into understandable terms. This requires the ability to explain investment strategies, market trends, and financial products in a way that clients can easily grasp. Additionally, wealth managers need to be strong listeners, understanding their clients’ financial goals, risk tolerance, and personal circumstances. The ability to build rapport, trust, and long-term relationships with clients depends on exceptional communication skills. Without these skills, a wealth manager will struggle to effectively serve their clients and build a successful career. You need to express your thoughts clearly to prospective employers to highlight your skills to potential employers.

Demonstrating Strong Interpersonal Skills

Interpersonal skills go beyond just communication; they encompass your ability to build and maintain relationships. In a wealth management internship cover letter, show how you work with others, resolve conflicts, and demonstrate empathy. You might describe a team project where you took a leadership role, or a volunteer experience where you provided support and guidance to others. Highlight your ability to work effectively in a team, to adapt to different personalities, and to resolve conflicts constructively. Mention any experience you have with customer service, sales, or relationship management. Demonstrating that you can build relationships with others is a key asset in wealth management. A great cover letter is one of the best ways to demonstrate those skills to potential employers.

Analytical and Problem-Solving Abilities

Analytical and problem-solving abilities are critical for success in wealth management. Advisors constantly analyze financial data, market trends, and client portfolios to make informed decisions. They need to be able to identify problems, evaluate options, and develop solutions that align with their clients’ financial goals. In your cover letter, highlight any experience you have in analyzing data, conducting research, or solving complex problems. This could include academic projects, internships, or even personal finance endeavors. Quantify your achievements whenever possible. For instance, if you improved the efficiency of a process, state the percentage of improvement. Show how you applied analytical skills to specific situations. Being able to show that you’re a strong analytical thinker is a great skill.

Showcasing Analytical Skills

To showcase your analytical skills, provide specific examples from your experience. Did you analyze financial statements as part of a class project? Did you research investment opportunities and present your findings? Did you use data to identify inefficiencies and recommend improvements? When describing these experiences, be specific about the tools and techniques you used. Did you use Excel, statistical software, or financial modeling techniques? The more concrete and detailed your examples are, the more effectively you’ll demonstrate your analytical abilities. Mention any coursework in finance, economics, statistics, or data analysis. Highlight your ability to interpret data, identify trends, and draw logical conclusions.

Problem-Solving in Wealth Management

Problem-solving is a core component of wealth management. Clients come to advisors with unique financial challenges, from planning for retirement to managing investments and navigating tax implications. Wealth managers must be able to assess these challenges, analyze the available options, and develop tailored solutions. In your cover letter, show how you approach problem-solving. Describe a situation where you identified a problem, analyzed its root causes, and developed a solution. Highlight your ability to think critically, weigh different perspectives, and make well-reasoned decisions. Mention any experience with critical thinking, decision-making, or strategic planning. Showing your ability to solve problems is key to being successful in the industry.

Understanding of Financial Markets

A solid understanding of financial markets is fundamental to a successful career in wealth management. Interns should have a basic knowledge of investment products, market trends, and economic indicators. Familiarize yourself with stocks, bonds, mutual funds, and other investment vehicles. Stay informed about current events in the financial world, such as interest rate changes, inflation, and geopolitical events. Be prepared to discuss these topics in your cover letter and during interviews. Reading financial news publications, following market analysts, and taking relevant coursework are great ways to build your knowledge base. Show your passion and that you’re a fast learner. This demonstrates your interest and dedication to the field.

The Role of Financial Market Knowledge

Financial market knowledge is essential for making sound investment decisions. Wealth managers need to understand how markets function, how different asset classes perform, and how economic factors influence investment returns. Clients rely on their advisors to navigate market volatility and to develop long-term investment strategies. By demonstrating a basic understanding of the markets, you showcase your interest in and preparedness for a wealth management internship. You can mention any coursework you have taken in finance, economics, or investment analysis. Mention any personal investment experience. It’s about showcasing your ability to research market trends, analyze financial data, and make informed investment decisions.

How to Demonstrate Market Understanding

In your cover letter, you can demonstrate your market understanding by mentioning any relevant coursework, certifications, or extracurricular activities. Reference any knowledge you have of economic indicators, interest rates, inflation, and other market forces. You might discuss recent market events and the impact they’ve had on the financial industry. Mention any experience you have with investment research, financial modeling, or portfolio analysis. Show that you are up-to-date on financial news and market trends. You can also briefly discuss your investment philosophy and the type of clients you are most interested in working with. This will show recruiters that you have knowledge of the field and that you’re dedicated to the field.

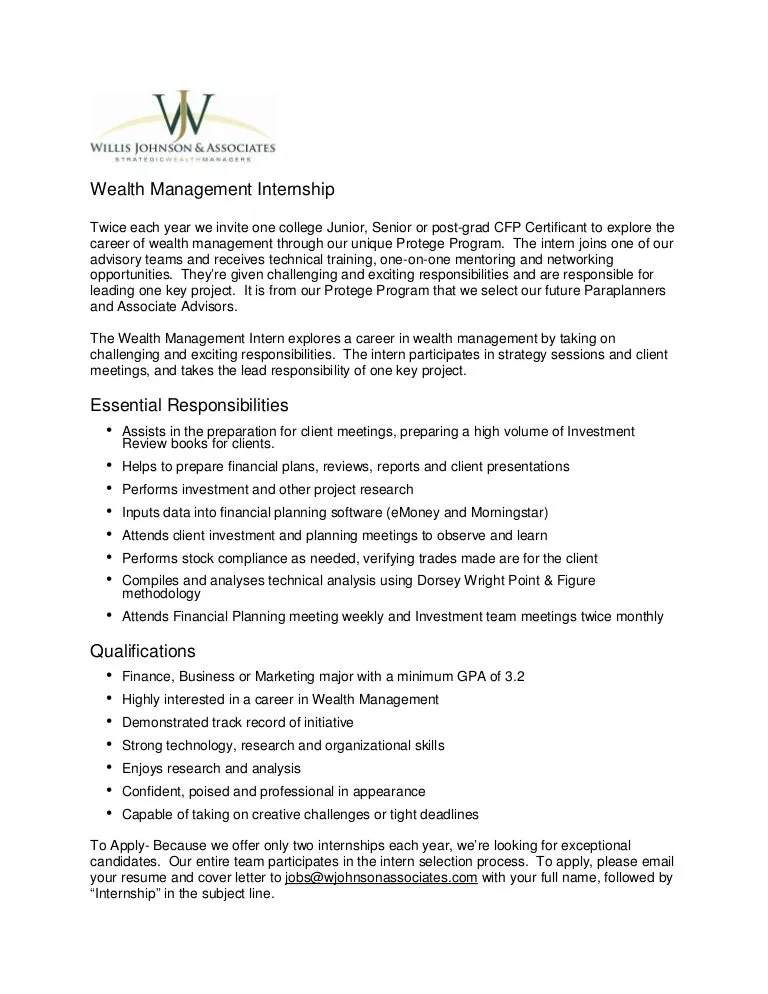

Proficiency in Relevant Software and Tools

Proficiency in relevant software and tools is a significant asset in wealth management. Many firms use specialized software for portfolio management, financial planning, and client relationship management (CRM). Common software includes financial planning tools like eMoney, investment analysis platforms, and CRM systems. Having a basic understanding of these tools can give you a significant advantage when applying for internships. Mention any software proficiency you have in your cover letter. If you have experience with Microsoft Excel, include it in your resume. Emphasize the value of the skills that are relevant to the position, such as financial modeling and data analysis. Show your openness to learning new programs. Being able to quickly adapt to new software will be a great asset.

Highlighting Software Skills

When highlighting your software skills, be specific about the programs you know and how you’ve used them. Did you use Excel to analyze financial data? Did you create financial models using specialized software? Did you use a CRM system to manage client information? Provide specific examples of how you’ve used these tools. Mention any relevant coursework or training you’ve completed. Even if you don’t have direct experience with industry-specific software, you can highlight your general computer skills and your willingness to learn new programs. Showing you have some baseline knowledge of the technology is essential in this industry. List these in a skills section.

Tools Commonly Used in Wealth Management

Wealth management firms use a variety of software and tools to manage client portfolios, create financial plans, and track performance. Some of the most commonly used tools include portfolio management software, financial planning software, and CRM systems. Portfolio management software helps advisors track investments, analyze performance, and generate reports. Financial planning software helps advisors create financial plans for clients, including retirement planning, education savings, and estate planning. CRM systems help advisors manage client relationships, track communication, and store client data. Familiarity with any of these tools, or similar software, can enhance your cover letter. This also showcases your passion and interest in the wealth management field.

Attention to Detail and Accuracy

Attention to detail and accuracy is extremely important in wealth management. Advisors handle sensitive financial information and make critical decisions that can significantly impact clients’ lives. Mistakes can have serious consequences. Being detail-oriented means carefully reviewing your work, paying attention to numbers, and ensuring that everything is accurate. In your cover letter, demonstrate your ability to proofread your work and to identify and correct errors. Mention any experience you have with data entry, report writing, or other tasks that require precision. Demonstrate your commitment to accuracy by carefully reviewing your cover letter for any typos, grammatical errors, or inconsistencies. This shows that you value precision and accuracy.

Why Attention to Detail Matters

In wealth management, accuracy is not just a matter of professionalism, it’s a legal and ethical requirement. Advisors handle sensitive financial information and are responsible for making critical decisions on behalf of their clients. Even small errors can have significant consequences, leading to financial losses, compliance issues, and damage to the firm’s reputation. A wealth management internship cover letter is no exception. Any errors will be held against you. Attention to detail demonstrates your respect for the role and your commitment to providing high-quality service. By highlighting your commitment to accuracy, you’ll show potential employers that you have the qualities they are looking for.

Proofreading and Ensuring Accuracy

Before submitting your cover letter, proofread it carefully for any errors. Check for spelling mistakes, grammatical errors, and inconsistencies in your formatting. Read the letter aloud to catch any awkward phrasing or unclear sentences. It can be helpful to have a friend, career counselor, or family member review your cover letter as well. They may spot errors that you’ve missed. Make sure the tone is professional, and that the letter addresses all the key points of the job description. The goal is to ensure that your cover letter is polished, professional, and error-free. By demonstrating your attention to detail in your cover letter, you’ll make a positive impression on potential employers.

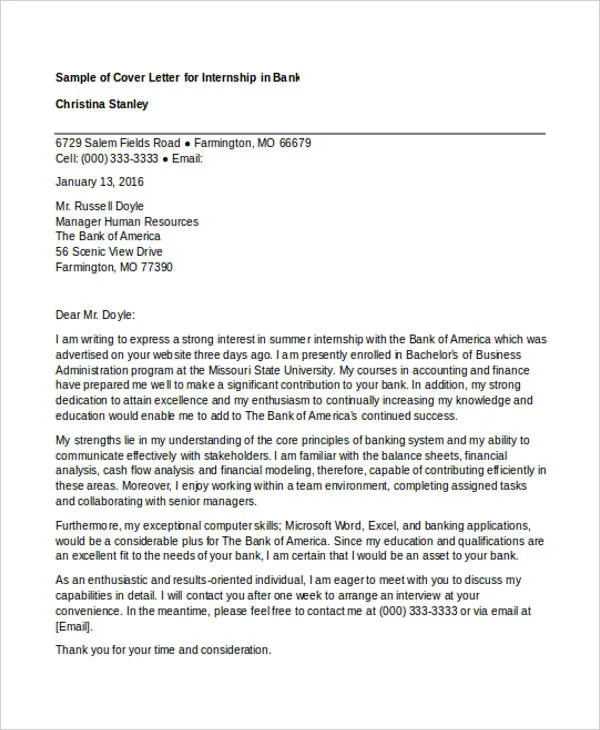

Tailoring Your Cover Letter for a Wealth Management Internship

One of the most important aspects of a successful cover letter is tailoring it to the specific internship and the company you are applying to. A generic cover letter will not make a strong impression. Instead, research the company, the role, and the requirements. Identify the key skills and qualifications the employer is seeking, and then tailor your cover letter to highlight your relevant experiences and abilities. Show the recruiter that you understand the company’s mission and values. When you take the time to tailor your cover letter, it shows that you are truly interested in the internship and that you have taken the time to understand what the company is looking for. A customized cover letter will make a much stronger impression than a generic one.

Researching the Company and Role

Before writing your cover letter, thoroughly research the company and the specific wealth management internship. Visit the company website and read about their mission, values, and services. Review the internship description carefully and identify the key responsibilities and qualifications. Look for information about the company’s culture, its employees, and its recent achievements. Understanding the company’s goals will help you tailor your cover letter to align with its needs. The more you know about the company and the role, the better you will be able to demonstrate your interest and to showcase your relevant skills and experiences.

Customizing Your Letter for Each Application

Once you’ve researched the company and the role, customize your cover letter to address the specific requirements and preferences of the employer. Start by addressing your letter to the hiring manager by name, if possible. In the opening paragraph, express your interest in the specific internship and explain why you are excited about the opportunity. Throughout the letter, highlight the skills and experiences that align with the job description. Use specific examples to demonstrate how you’ve used these skills in the past. In your closing paragraph, reiterate your interest in the internship and thank the employer for their time and consideration. Customize each cover letter you send to show the employer that you care.